Factors That Derail Compliance During Expansion Project

Table of Contents

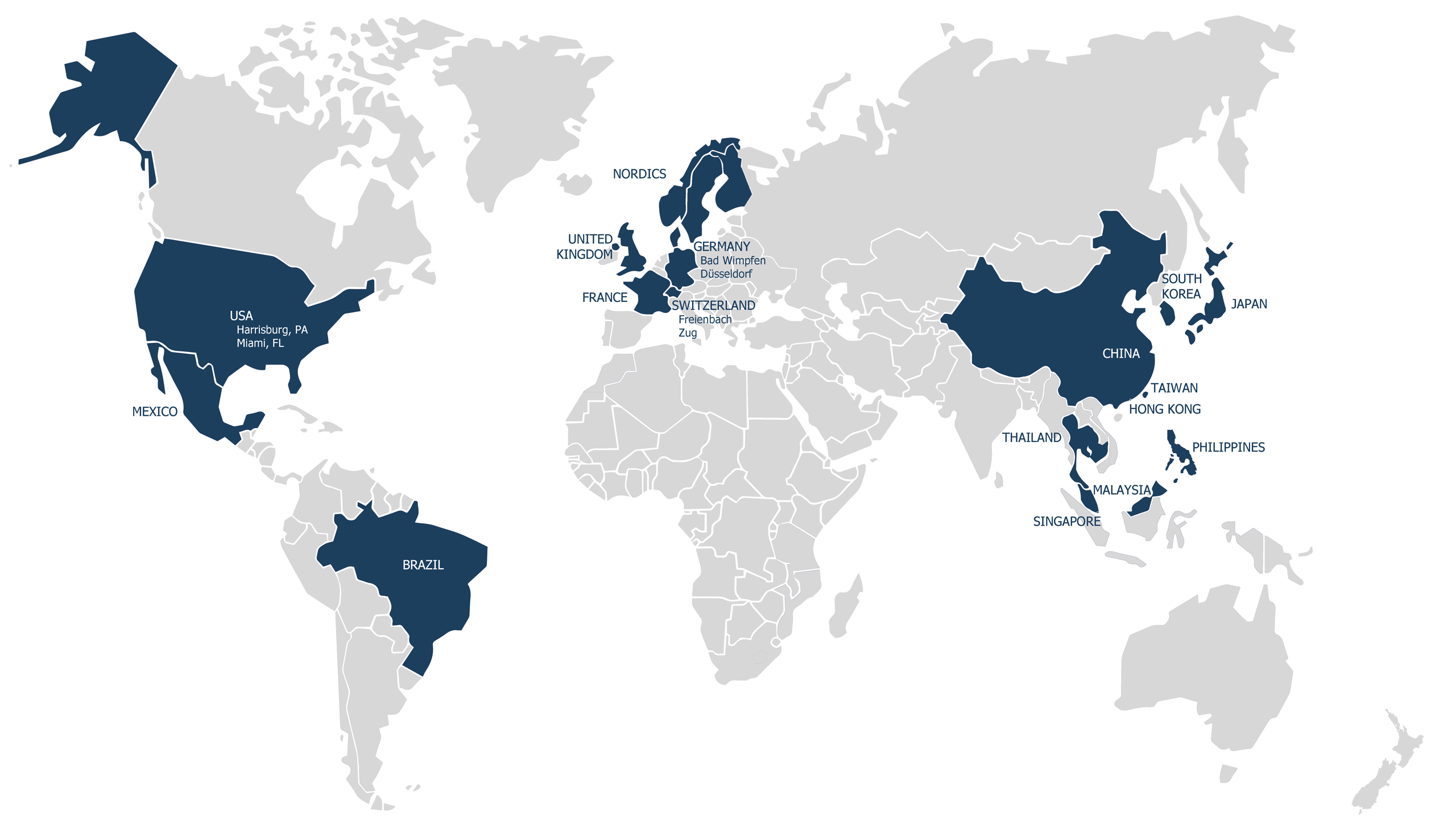

CloseWe’ve seen it time and again: a business tries to speed up their expansion process and opts to hire a local employee through headquarters or use the same ERP (Enterprise Resource Planning) software that they use in other countries and they find themselves in non-compliance. This often leads to a bad reputation before even opening up shop, with fines and a whole myriad of new issues to resolve.

Compliance failures can be as big as $150 billion dollar internationally renowned cover-ups, but they can also be little mistakes made along the way just because managers didn’t know what they didn’t know. Compliance failures of financial institutions alone amounted to 10.4 billion in 2020, so to keep from contributing your funds to that pot, here are two major steps your business can take to avoid a compliance failure.

Processes and Process Documents

The top crucial step to avoid a compliance failure is to ensure that your business has succinct and thorough processes and process documents. Compliance is key, and to get there will mean having the right process in place.

The right processes include well-documented roles and responsibilities and thorough and accurate data documentation, without which many issues can arise. As we all know, back-end implementing processes is far more labor and time-intensive.

Proper processes also enhance data privacy and cybersecurity. Whether your company is holding its own data or the data of clients, cybersecurity is a huge concern. With international businesses sending more and more data across borders, around the world, and locally, companies must have processes in place to keep up with security and processes in place for if (and when) security is breached.

Often companies don’t have a problem with the business side of things by the time they’re ready for expansion. Still, their underlying processes are not standardized enough to keep up with the quick changes during expansion. Before embarking into a new country, companies need to fully understand the processes that are currently in place and map out any gaps.

Based on these systems, it is important to choose the right technology or ERP to support and enhance these processes to avoid compliance failure. A simple “lift and shift” approach in moving from one country into another won’t cut it either, because compliance regulations can be vastly different from one country to the next, so even if you have a great head office compliance system and processes, doesn’t mean you won’t have to adapt in the new location.

For the reasons of navigating these complexities, it is critical to partner with specialists in the field and choose supportive technology to ensure a smooth transition.

The Right Supportive Technology

All of the continual changes to compliance (e-filing, e-taxing, e-audits, upstream tax administration) demonstrate the need to use an ERP system with the right processes in a way that is localized with the right considerations.

Many countries have particular regulations around ERP systems themselves. Portugal will only accept ERP systems certified by their government, and Asian-Pacific markets’ compliance codes are very complex but also complicated in their geographical diversity; around the world, compliance regulations are rapidly growing in complexity.

Increased financial transparency is also expected now more than ever, and because of this companies are having to report more and more often to local authorities. Having the right supportive ERP technology can make transfers and transparency to local authorities a seamless process. This will, of course, require a compatible ERP system.

Choose the right ERP now so you can focus on your business during the transition and not worry about compliance. Working with an ERP partner like the global SAP rollout experts at be one solutions can remove most if not all of the stress of expanding into a new location. Make the right choices from the start, so your business doesn’t go down due to compliance failure.

You won’t want to miss be one solutions‘ next webinar. Add your email address to be notified :

Please select your language

Welcome on be one solutions‘ websites.

Please select your language.