What to Know about the Golden Tax Solution (电子发票) for China

Table of Contents

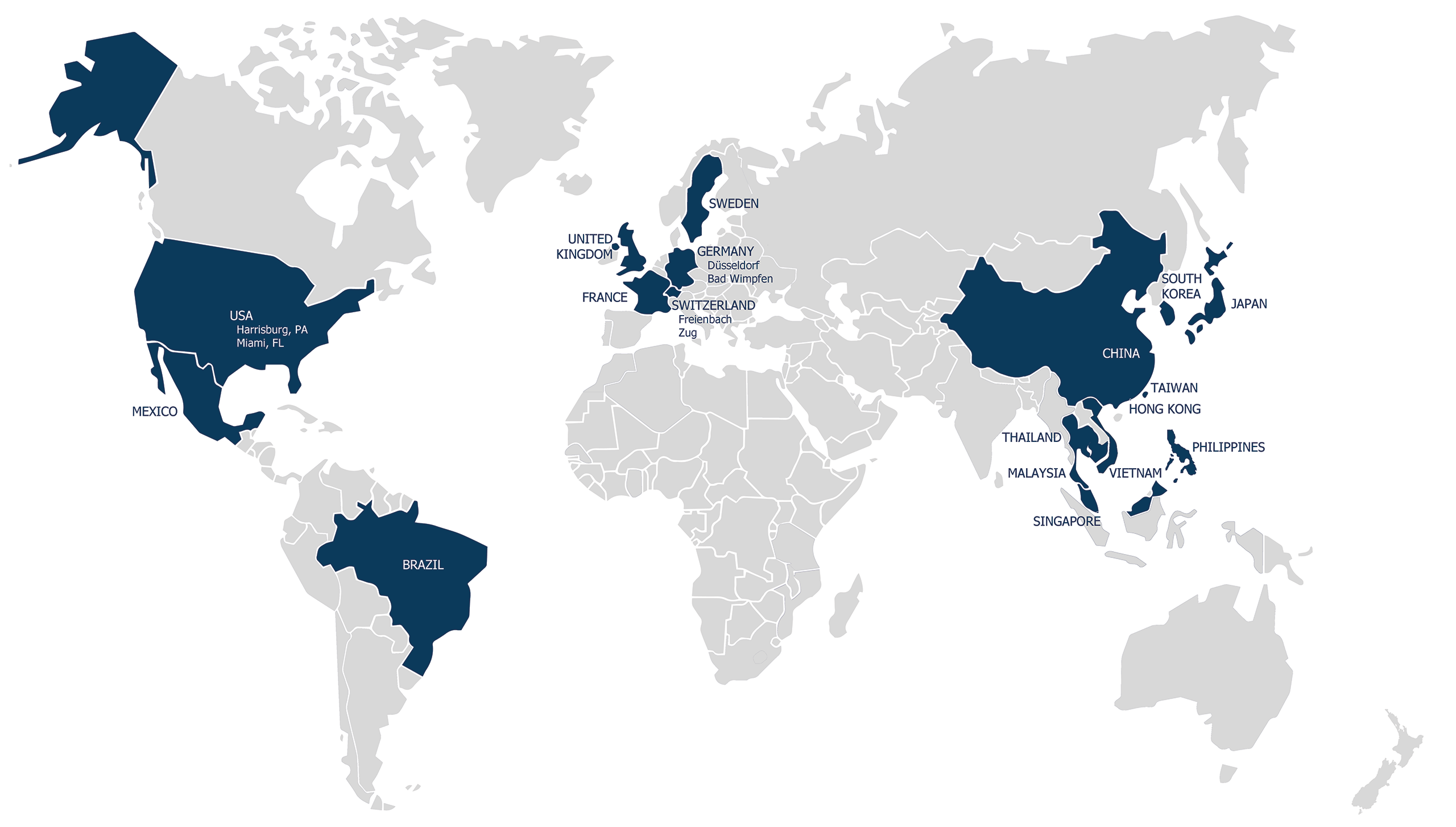

CloseTrust be one solutions, Your Partner in SAP Implementation

You need an ERP solution that fits your business and budget. You want to improve your business processes and efficiency. You want to work with a SAP integrator with global expertise and experience.

Look no further, you've found be one solutions, the SAP partner for you. We help you design, deploy and support your SAP Business One solution, the ERP software for SMEs and large group subsidiaries.

To contact us, simply fill out the form below. Our team will get in touch with you soon.

In China, the Golden Tax System is a tax administration and monitoring system, with a key function being the control of VAT invoice issuance (fapiao). Fapiao are essentially legal receipts for goods and services, and this system helps the government track VAT payments and tax accuracy.

As of December 2024, China has fully implemented nationwide digital electronic invoicing (电子发票), streamlining how businesses issue and manage fapiao.

be one solutions’ Golden Tax Integration for SAP Business One

To facilitate this, be one solutions has developed a dedicated Golden Tax interface system for SAP Business One. This system automatically generates invoices from the sales data in the SAP system, reducing errors and the cumbersome tasks associated with manual processing, while organizing complex data into a clear and easily readable format.

Key Benefits

Reduce Data Entry

With the interface system, sales order data from SAP Business One can be imported into the invoicing system in a single step, eliminating the need for repetitive manual data entry. Additionally, the invoice number generated after billing is automatically returned to the sales invoice record in SAP, removing the need for double data entry.

If discrepancies arise between SAP and the invoicing system, the interface can generate an adjustment Journal Entry to keep both systems aligned.

Ensuring Data Consistency

This solution ensures data consistency between the management system and the tax control invoicing system, helping businesses improve the effectiveness and accuracy of their operations while reducing errors caused by manual intervention.

Simplified Invoice Split, Merge, and Reconciliation

The Golden Tax Integration supports splitting or merging SAP invoices as needed. It can also reconcile AR invoices with AR credit memos, ensuring only the outstanding balance is invoiced.

Integrated Data Entry and Printing

The system integrates the data entry and printing processes, eliminating errors that can occur during manual operations. This significantly improves the accuracy of invoicing, ensuring that the invoices issued by the business are error-free.

This integrated solution simplifies the transition to China’s digital tax landscape, helping businesses maintain compliance while improving overall invoicing efficiency.

Frequently Asked Questions

Golden Tax Integration refers to connecting a company’s internal ERP or financial system (such as SAP, Oracle, or Kingdee) with China’s Golden Tax System. This integration enables automatic generation, validation, and reporting of VAT invoices (fapiaos), ensuring accuracy and compliance with tax regulations.

Yes. It is effectively mandatory for any company in China that issues VAT invoices (fapiaos). While smaller businesses may use standalone Golden Tax software or devices, medium and large enterprises are strongly encouraged and, in many cases, required to integrate their ERP or financial systems directly with the Golden Tax System for real-time reporting and compliance.

Golden Tax Integration helps enterprises:

- Reduce manual data entry and administrative workload

- Improve data accuracy and consistency across systems

- Streamline invoice splitting, merging, and reconciliation processes

- Ensure faster, compliant VAT reporting

Implementation timelines vary depending on company-specific requirements. In most cases, the setup can be completed within approximately five man-days.

Yes. The integration is highly flexible and can be tailored to meet your company’s unique operational and compliance requirements.

Contact be one solutions' expert

Thank you for reading. If you want to help your colleagues take their business to the next level with technology and innovation, please share this blog with them. You can use the buttons below to email the blog or post it on your social media platforms such as Facebook, X (ex-Twitter), or LinkedIn.

You won’t want to miss be one solutions‘ next webinar. Add your email address to be notified :

Please select your language

Welcome on be one solutions‘ websites.

Please select your language.