E-Invoicing Revolution: How Southeast Asia is Embracing Digital Taxation

Across Southeast Asia, governments are actively introducing regulations and incentive schemes to accelerate business adoption of e-invoicing. Beyond the existing ASEAN Free Trade Area (AFTA), the upcoming ASEAN-China Free Trade Area (ACFTA) 3.0, set to be signed this year, signals even greater growth potential for the region. This next phase of trade liberalisation and deeper multilateral cooperation underscores Southeast Asia’s strategic position in an increasingly dynamic and interconnected global economy.

Table of Contents

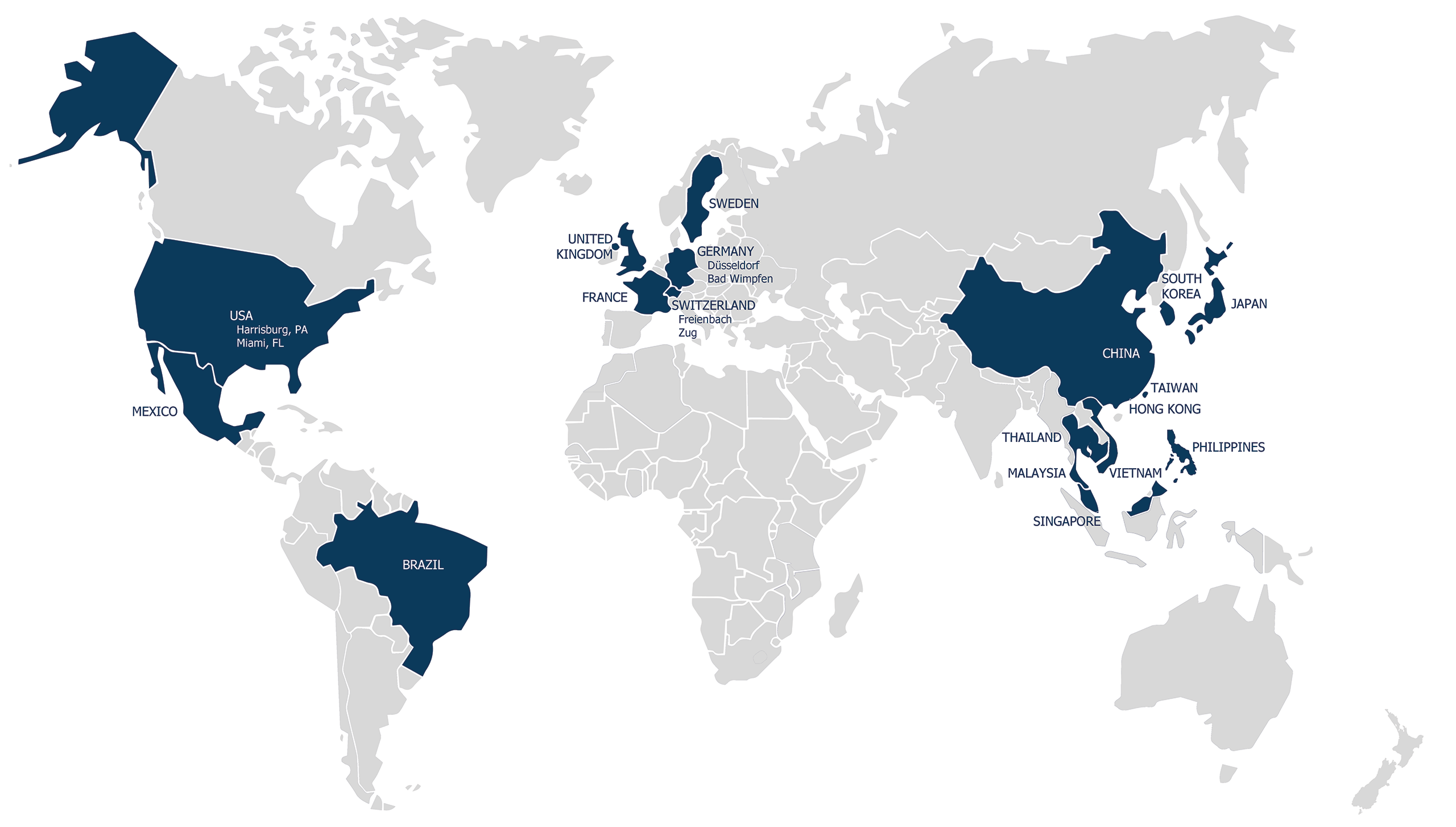

CloseTrust be one solutions, Your Partner in SAP Implementation

You need an ERP solution that fits your business and budget. You want to improve your business processes and efficiency. You want to work with a SAP integrator with global expertise and experience.

Look no further, you've found be one solutions, the SAP partner for you. We help you design, deploy and support your SAP Business One solution, the ERP software for SMEs and large group subsidiaries.

To contact us, simply fill out the form below. Our team will get in touch with you soon.

Malaysia

To support the growth of the digital economy, the Inland Revenue Board of Malaysia (also known as LHDN) is implementing e-invoice in stages to enhance tax administration management.

To encourage businesses to implement e-invoicing, the Malaysian government has announced a tax deduction of up to RM50,000 for each year of assessment on related expenditure for the implementation of e-Invoice incurred by SMEs valid until 2027.

According to the implementation timeline, taxpayers with an annual turnover or revenue exceeding RM500,000 will need to implement e-Invoicing by 1 July 2025.

| Targeted Taxpayers | Implementation Date |

|---|---|

| Taxpayers with an annual turnover or revenue of more than RM100 million | 1 August 2024 |

| Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million | 1 January 2025 |

| Taxpayers with an annual turnover or revenue of more than RM500,000 and up to RM25 million | 1 July 2025 |

| Taxpayers with an annual turnover or revenue of up to RM500,000 | 1 January 2026 |

To find out more about the E-invoicing initiative in Malaysia, visit: https://www.beonesolutions.com/blog/how-sap-b1-and-einvoicing-can-optimize-your-finance-processes-malaysia/

Singapore

The Infocomm Media Development Authority (IMDA) in Singapore introduced the nationwide e-invoicing network, InvoiceNow, in 2019 to facilitate the direct transmission of invoices in a structured digital format across finance systems.

In April 2024, the second phase, GST InvoiceNow, was announced. Starting from May 2025, GST InvoiceNow will enable businesses to send e-invoice data to IRAS via accredited providers, offering benefits such as faster GST refunds, automated alerts, fewer audits, and improved risk assessment.

The mandatory participation timeline is as follows:

- From 1 November 2025, for newly incorporated companies that register for GST voluntarily.

- From 1 April 2026, for all new voluntary GST-registrants.

For further details on InvoiceNow for Singapore, visit: https://www.beonesolutions.com/blog/grow-your-business-with-invoicenow-and-sap-business-one/

Indonesia

Indonesia's electronic invoicing system, e-Faktur, has been mandatory since July 2016 for taxpayers with annual sales exceeding IDR 4.7 billion.

In July 2024, the government revealed plans to develop the Core Tax System (Pembaruan Sistem Inti Administrasi Perpajakan, or PSIAP) aimed at automating and digitizing tax administration services. This system will allow taxpayers to independently access services, automatically fill out tax return forms, and enhance transparency for taxpayers.

Thailand

The e-Tax Invoice and e-Receipt system is a government-endorsed digital initiative aimed at modernizing tax processes in Thailand. Introduced by the Revenue Department (RD), this system enables businesses to issue, transmit, and store tax invoices and receipts electronically, replacing traditional paper-based methods. The goal is to establish a fully integrated digital tax ecosystem for all Thai businesses by 2028.

Thailand’s Revenue Authority has approved several incentives for taxpayers to adopt the e-Tax System. Eligible companies can benefit from double deductions for Corporate Income Tax for expenses relating to the investment in the e-Tax invoice and e-Receipt systems, as well as reduced Withholding Tax Rate of 1% for specific payments made through the e-Tax system, valid until December 31, 2025.

Philippines

The Philippines’ Bureau of Internal Revenue (BIR) mandates e-invoicing for majority of taxpayers and e-commerce businesses by March 2026. Businesses must comply with the Electronic Invoicing System (EIS) portal, electronic invoice reporting, and tax regulations.

Under the CREATE MORE (Corporate Recovery and Tax Incentives for Enterprises to Maximise Opportunities for Reinvigorating the Economy) Act, signed in November 2024, the Philippines introduced a law reducing corporate tax rates from 25% to 20%, aiming to attract foreign investment.

Vietnam

Since July 2022, Vietnam has mandated the issuance of electronic invoices for organizations, companies, and individuals providing goods or services, with continued government efforts to encourage adoption.

One such initiative is the ‘lucky invoice’ programme, which rewards consumers for requesting invoices to combat tax evasion. Additionally, the government has launched public awareness campaigns highlighting the long-term benefits of e-invoicing.

At the end of 2024, 92,080 business establishments had registered to use e-invoices generated via cash registers, a significant 2.3-fold increase compared to 2023.

What be one solutions e-Invoicing Offers

To support your enterprise in meeting e-invoicing regulations, it is essential to invest in a centralized system capable of managing end-to-end business and financial operations, tax reporting, and other regulatory compliance requirements.

be one solutions offers a strong international presence, providing localized language support tailored to the specific needs of each entity’s country and language. Our global team ensures your users receive seamless, multilingual assistance across various time zones.

Summary

E-invoicing is rapidly transforming the business landscape across Southeast Asia, fuelled by bold government initiatives and ambitious digital transformation goals. As companies embrace these advanced tax ecosystems, they unlock greater efficiency, seamless compliance, and a more interconnected regional trade network, positioning themselves at the forefront of a smarter, more agile digital economy.

Thank you for reading our blog post. Read more articles if you want to learn more about how SAP and be one solutions can help you grow your business globally.

Contact be one solutions' expert

Thank you for reading. If you want to help your colleagues take their business to the next level with technology and innovation, please share this blog with them. You can use the buttons below to email the blog or post it on your social media platforms such as Facebook, X (ex-Twitter), or LinkedIn.

You won’t want to miss be one solutions‘ next webinar. Add your email address to be notified :

Please select your language

Welcome on be one solutions‘ websites.

Please select your language.