Optimize Your Finance Processes in Malaysia with SAP Business One and E-invoicing

Blog Summary

E-invoicing is changing the way businesses in Malaysia handle their finance and accounting processes. It is a digital initiative by the IRBM to make tax compliance easier, prevent tax fraud, and boost business efficiency. E-invoicing saves time and money by avoiding manual errors and paper waste. It also allows data to flow smoothly between systems and ensures transaction visibility.

SAP Business One is a powerful ERP system that can work with e-invoicing and other solutions. SAP Business One helps you create and manage invoices easily and follow the industry standards for financial reporting and processes. It is a flexible solution that can be tailored to your industry needs.

If you want to grow your business in Malaysia, you need to optimize your financial processes with technologies like SAP Business One. Our team in Malaysia can show you how SAP Business One can help your organization. Contact us today for a free demo session.

Table of Contents

CloseIn a fast-paced business environment, optimizing processes is essential for business success. For instance, manual invoice processing has been a big challenge for many companies. It hinders business advancement for several reasons such as duplicate payments, overdue payments, misplacement of invoices, and data inaccuracies. Consequently, digitalized administration is required in finance and accounting processes to accelerate business growth. As such, tax authorities in several countries like Singapore, Japan, and France have already taken proactive measures by introducing and enforcing the practice of E-invoicing. This initiative is a part of the efforts to evolve traditional business into digital-driven business.

E-invoicing initiative in Malaysia

As a stride toward the digital transformation journey, the Inland Revenue Board of Malaysia (IRBM) (also known as Lembaga Hasil Dalam Negeri Malaysia - LHDM) introduced an e-invoice initiative early this year. According to IRBM’s implementation timeline, taxpayers with an annual turnover or revenue of more than RM 100 million are the first category to implement e-invoicing by August 2024. The new implementation enhances the tax administration process and overall tax compliance while allowing the tax authority to track and trace the origin of invoices, thus reducing instances of tax evasion. This digital shift encourages compliance and transaction transparency, and improves business productivity, as a remedy against tax leakage and any unreported revenue from illegal businesses.

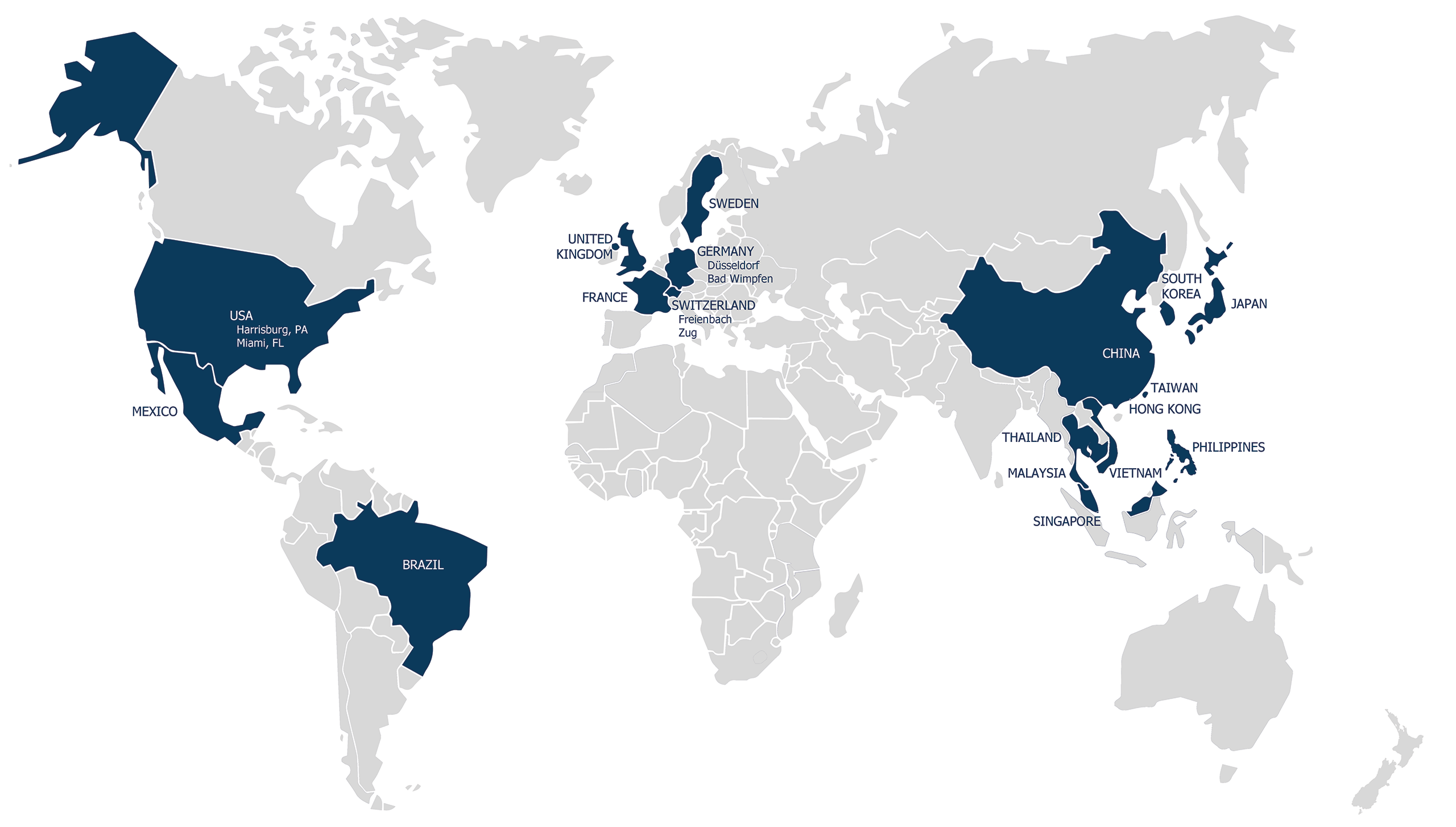

Trust be one solutions, Your Partner in SAP Implementation

You need an ERP solution that fits your business and budget. You want to improve your business processes and efficiency. You want to work with a SAP integrator with global expertise and experience.

Look no further, you've found be one solutions, the SAP partner for you. We help you design, deploy and support your SAP Business One solution, the ERP software for SMEs and large group subsidiaries.

To contact us, simply fill out the form below. Our team will get in touch with you soon.

In the current scenario, manual handling of invoices consumes a considerable amount of time, paper, and space to store the hard copies. This process is inefficient and prone to errors and negative environmental impacts. Adopting an e-invoice system in the country offers numerous benefits to companies including time and cost savings. By transitioning to e-invoicing, companies will be able to upload and store their purchase records within the system of the Inland Revenue Board of Malaysia (IRBM). This eliminates the need for companies to keep physical copy invoices and enhances efficiency through seamless data integration. A seller creates an e-invoice in XML or JSON format and shares it with IRBM through the MyInvois Portal or API for validation. Once the e-invoice is validated, the seller will receive a Unique Identifier Number which makes the invoice traceable. Meanwhile, both seller and buyer will be notified once the e-invoice has been verified. After that, the seller is required to share the validated e-invoice which has a QR code that holds a validated link to the buyer. After the e-invoice is generated, both parties are given a period to either reject or cancel it. Lastly, both seller and buyer can acquire the overview of the e-invoice transactions via the MyInvois Portal.

Learn more about how e-invoicing is implemented and regulated in other countries. Read the articles that explain the benefits and challenges of e-invoicing for businesses and tax authorities.

Integrating SAP Business One with E-invoicing

How can organizations best prepare for the shift from traditional to electronic means of issuing invoices before its full implementation? Primarily, taxpayers have the ability to choose the most appropriate mechanism developed by IRBM to transmit e-invoices according to their specific business needs, which is either through the MyInvois Portal hosted by IRBM or through an Application Programming Interface (API). The latter option - API is certainly ideal for businesses with a significant transaction volume. API connections can be established directly with IRBM or via intermediary technology service providers.

To simplify matters, the fundamental preparation for an organization is to equip itself with a comprehensive enterprise resource planning system such as SAP Business One, including a full suite of accounting and financial modules. With the integration of SAP Business One, companies are not only able to generate and manage invoices effortlessly but also to harmonize their financial reporting and processes per industry norms. SAP Business One is a simple yet powerful solution for midsize and large enterprises with overseas subsidiaries. Apart from the Accounting and Financial module, SAP Business One is also a highly customizable system that can integrate with a wide range of add-on solutions such as Warehouse Management System, Dealer Management System, and Manufacturing. These industry-specific add-on solutions were developed to tackle the main challenges faced by respective industries.

Conclusion

As Malaysia embarks on its path towards digital transformation, technological shift is crucial in business advancement. Optimizing financial processes helps expedite payment cycles and improve cash flow, which is crucial for expanding the business. Before modernizing operation processes, investing in an enterprise resource planning system (ERP) should be prioritized. Our team of seasoned consultants has vast experience in SAP Business One implementation and localization regulations in over 60 countries. Reach out to our team in Malaysia today and schedule a free demo session to further understand how we can help you on this!

Contact be one solutions' expert

Olli Kylänpää

Managing Director APAC be one solutions

Contact our experts now! Click here!

Thank you for reading. If you want to help your colleagues take their business to the next level with technology and innovation, please share this blog with them. You can use the buttons below to email the blog or post it on your social media platforms such as Facebook, X (ex-Twitter), or LinkedIn.

You won’t want to miss be one solutions‘ next webinar. Add your email address to be notified :

Please select your language

Welcome on be one solutions‘ websites.

Please select your language.