Reform for Electronic Invoicing in France: 10 Expert Tips for a Smooth Transition

Blog Summary

Table of Contents

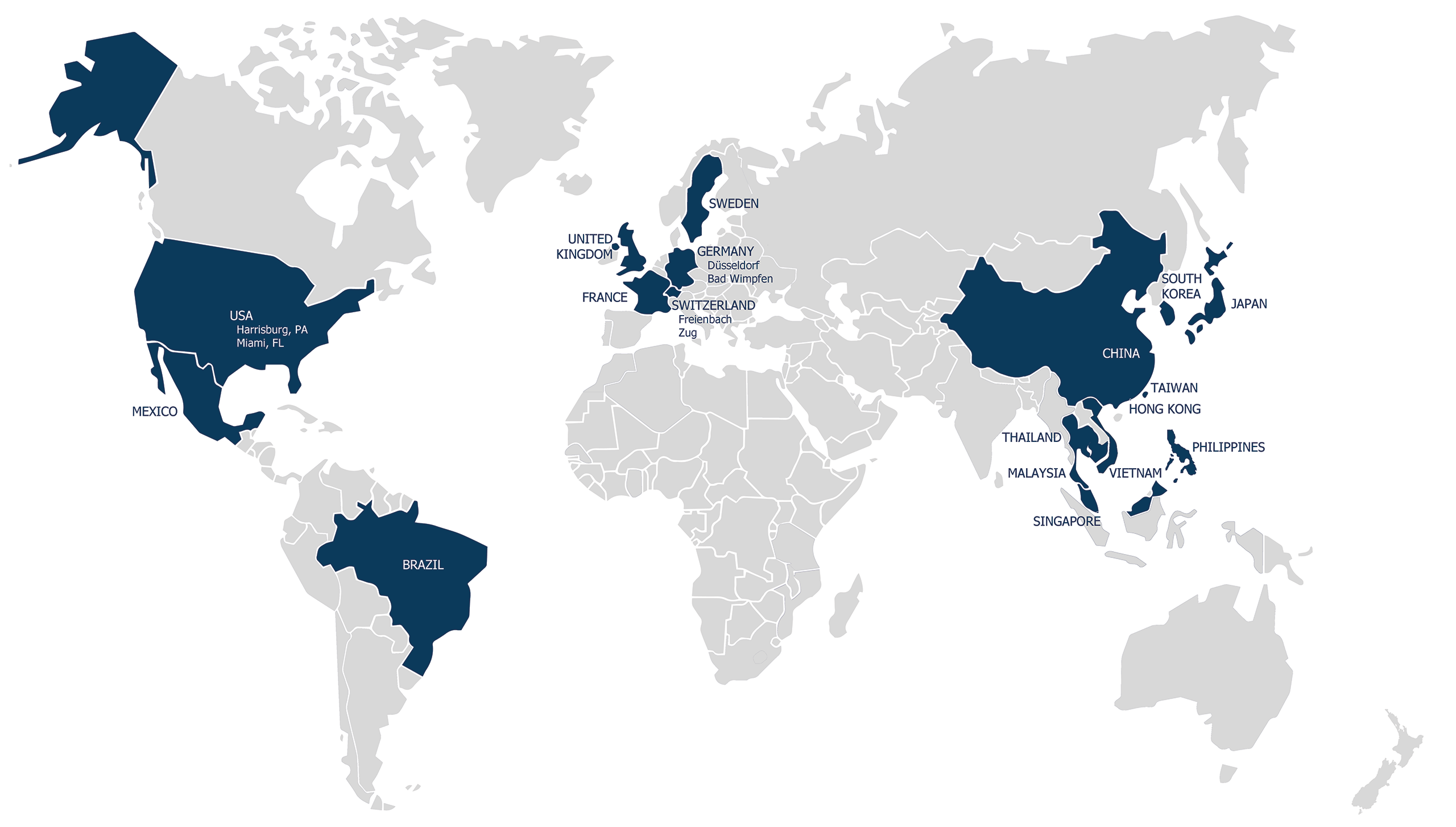

CloseTrust be one solutions, your partner in SAP implementation

Are you looking for an ERP solution adapted to your needs and your budget? Do you want to optimize your business processes and gain in efficiency? Would you like to benefit from the expertise and know-how of a world-renowned SAP integrator?

Stop looking around, you're in the right place ! be one solutions is the SAP partner you need. We support you in the design, deployment and support of your SAP Business One solution, the ERP software dedicated to SMEs and subsidiaries of large groups.

Whether you are in industry, commerce or services, we have the solution that meets your expectations and your specificities. We offer you a personalized approach, based on listening, proximity and customer satisfaction.

To contact us, simply fill out the form below. Our team will get in touch with you soon.

The entry into force of the generalization of electronic invoicing, initially planned for 2024, has been postponed following a decision taken in the context of regular consultations with stakeholders. The postponement will make it possible to guarantee the time necessary for the success of this reform, which is economically structuring.

Following the implementation of this reform, all transactions between companies subject to VAT, established in France, will be required to be dematerialized. This reform on the dematerialization of invoices aims to generalize e-invoicing, ie the use of electronic invoices.

This reform also serves to transmit invoicing data to the tax authorities. We then speak of e-reporting.

The implementation of an ERP adapted to the needs and constraints of companies allows them to benefit from the advantages of the dematerialization of invoices, such as regulatory compliance, productivity gains, cost reduction or data security.

Here are our ten tips to support you in this digitalization.

-

Comprehend Invoice Digitization and Its Associated Challenges

The main principle of operation of invoice digitization is to replace paper invoices with electronic invoices, that is to say digital files which contain the same information and which have the same legal value.

-

Adhere to Timelines and Processes for Invoice Digitization According to Customer Type

The deadlines and the conditions to be met for invoice digitization depend on the type of customer.

Mandatory digitization for public customers commenced on January 1, 2020.

For private customers, the new dates will be determined within the framework of the finance law for 2024. To find out more, visit the website: https://www.economie.gouv.fr/cedef/facturation-electronique-entreprisesTo fulfill these obligations, you must choose between utilizing an administration-affiliated digitization platform or the Chorus Pro public invoicing portal.

-

Mitigate Risks Linked to Non-Compliance with Invoice Digitization

Numerous risks arise if your company neglects to implement invoice digitization, including time loss, financial implications, reduced productivity, decreased competitiveness, compromised traceability, security lapses, and non-compliance consequences. Non-compliance with electronic invoicing and invoicing data transmission constitutes legal breaches for French companies, resulting in financial penalties:

- A fine of €15 for each non-electronic invoice, up to a maximum of €15,000 per annum.

- A fine of €250 for failing to transmit billing data, up to a maximum of €15,000 per annum.

-

Verify Compatibility of Your IT Infrastructure for Invoice Digitization

Your computer system is deemed compatible for invoice digitization if it adheres to prevailing technical and legal standards. Notably, it should generate, transmit, receive, store, and archive electronic invoices in XML or signed PDF formats. Additionally, it must guarantee the authenticity, integrity, and legibility of electronic invoices.

-

Implement Invoice Digitization within Your Company

To initiate this process, several steps need to be followed: evaluate your present status, select a suitable software solution, train your workforce, inform your clients and suppliers, configure your IT system, assess process functionality through testing, and implement the transition incrementally.

-

Identify Key Stakeholders Involved in Invoice Digitization

The primary actors in charge of implementing invoice digitization encompass your company (invoice issuer or recipient), your customers (invoice issuer or recipient), your software provider (solution provider), your trusted third-party provider (electronic signature or timestamp service provider), and your archiving service provider (electronic archiving service with probative value provider).

The tax authority governs and collects invoicing data transmitted by companies, furnishing the Chorus Pro public invoicing portal, allowing companies to issue, receive, and transmit electronic invoices, along with transaction and payment data.

-

Estimate the Cost of Invoice Digitization

The expenses associated with implementing electronic invoicing vary based on your company's size, invoice volume, chosen software solution, and supplementary services availed. Factors to consider include software acquisition or subscription costs, installation and configuration expenses, training and support charges, maintenance and update costs, as well as third-party service fees (electronic signature, timestamping, archiving).

-

Manage Errors and Disputes Linked to Invoice Digitization

The right to rectify errors is governed by the adversarial principle. In the event of receiving an erroneous or incomplete e-invoice, rejection or dispute with the supplier is an option. Similarly, if an incorrect or incomplete electronic invoice is dispatched, it can be corrected or canceled with the customer. It is essential to adhere to the deadlines and terms stipulated by contracts or regulations.

The chosen software solution for invoice digitization should possess the capability to address errors arising during invoice issuance or receipt, encompassing format, content, signature, transmission, or storage.

The software solution must also allow you to correct errors if necessary, respecting the compliance rules applicable in each country. In France, you must issue a corrective invoice in the event of an error on an electronic invoice.

-

Ensure Security and Confidentiality of Electronic Invoices

The level of security and confidentiality surrounding digitization is paramount. Electronic invoices are safeguarded by technical mechanisms (encryption, electronic signatures, timestamps) and legal measures (contracts, laws) that ensure authenticity, integrity, and legibility. Personal or sensitive data must be treated in accordance with the General Data Protection Regulation (GDPR).

-

Retrieve and Integrate Supplier Invoices in Electronic Format

You can retrieve your supplier invoices in electronic format to integrate them into your accounting tool if your suppliers send them to you in this format and if your accounting tool is able to process them. Solutions exist that convert paper invoices into electronic equivalents through scanning or optical character recognition (OCR). Additionally, software solutions enable synchronization of electronic invoices with your accounting system via interfaces or gateways.

Successfully transition to electronic invoicing with the expertise of be one solutions and SAP Business One

To make a successful transition to electronic invoicing, you can count on the expertise and know-how of be one solutions, a trusted partner who supports you in setting up an ERP (Enterprise Resource Planning) solution adapted to your your needs. Specialized in integrating SAP Business One, an ERP solution designed for small and medium-sized businesses, be one solutions enables easy and efficient management of invoice digitization, while adhering to pertinent standards and regulations in each jurisdiction. You also benefit from better visibility and better traceability of your financial flows, which allows you to optimize your accounting and tax management. Waste no time; contact be one solutions today to find out how SAP Business One can help you successfully transition to electronic invoicing!

How to optimize your business management with SAP Business One? Discover best practices, tips and trends

Contact be one solutions' expert

You won’t want to miss be one solutions‘ next webinar. Add your email address to be notified :

Please select your language

Welcome on be one solutions‘ websites.

Please select your language.