Creating Year-End Closures with SAP Business One

Overview

As the fiscal year wraps up, every business faces the critical task of closing its financial books. In the realm of efficient and precise year-end closures, SAP Business One emerges as a game-changer. Whether you're already using this tool or considering it, let's delve into how it can make your year-end financial processes smoother.

Table of Contents

CloseSimplified Year-End Closures

Setting up new accounting periods is one of the most significant steps in the year-end closing process in SAP Business One. This action not only aligns your financial data with the new business year, but also paves the way for facilitating precise and organized financial management. Here's how you can achieve this:

- Navigate to Administration > System Initialization > Posting Periods.

- Choose "New Period" to create the upcoming business year.

- Define the start and end dates for the new period.

- Ensure that all posting periods for the previous year are closed.

- Save your changes, and your new posting period is set up.

- Establishing new document number ranges in SAP Business One.

Trust be one solutions, Your Partner in SAP Implementation

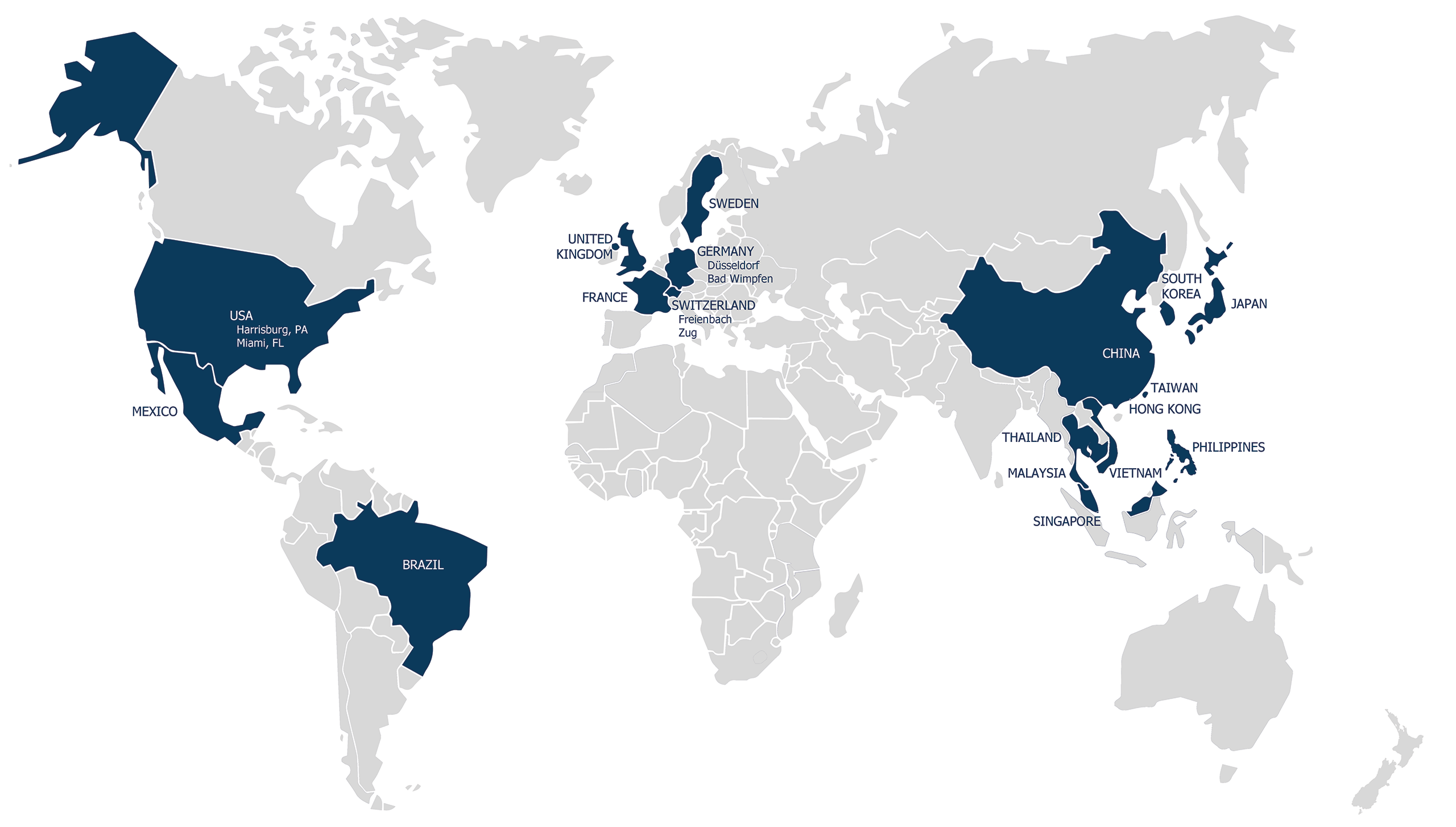

You need an ERP solution that fits your business and budget. You want to improve your business processes and efficiency. You want to work with a SAP integrator with global expertise and experience.

Look no further, you've found be one solutions, the SAP partner for you. We help you design, deploy and support your SAP Business One solution, the ERP software for SMEs and large group subsidiaries.

To contact us, simply fill out the form below. Our team will get in touch with you soon.

Establishing New Document Number Ranges

Maintaining order and structure in your financial documents is key to a successful financial year-end closing. SAP Business One simplifies this by allowing you to create new document number ranges. This ensures that your records for the upcoming business year differ from the previous year, avoiding confusion or overlap. Here's how you can do it in SAP Business One:

- Go to Administration > Document Numbering.

- Select the document for which a new number range is to be created.

- Click "Add Row" to create a new range for the upcoming fiscal year.

- Define the start and end numbers for the range.

- Assign this new range to the corresponding document type.

Planning the Technical Year-End Closing in SAP Business One

The technical year-end closing is a critical step in the annual financial closing process. This process finalizes the financial transactions of the past year and prepares your books for a fresh start in the new business year by zeroing out income statement accounts. SAP Business One makes this task easy due to its precise and straightforward process. Let's now dive into planning the technical year-end closing, a process that may sound complex but is quite straightforward with the right approach:

- Navigate to Administration > Utilities > Period-End Closing.

- Select the desired period for year-end closings.

- Review and correct your income statement accounts and balance sheet. If the numbers are accurate, proceed with the posting wizard.

- Ensure all relevant accounts are properly closed.

- SAP Business One guides you through the process, making it efficient and error-free.

Year-End Transition in Fixed Assets

For businesses dealing with fixed assets, the transition of the business year in the fixed assets domain is crucial. With SAP Business One, this transition is straightforward. Additionally, be one solutions can assist you in adjusting your fixed asset accounting to the new business year, ensuring depreciation schedules and other critical details are correctly updated. This step is vital for accounting clarity and compliance with legal requirements.

- Navigate to Financials > Fixed Asset Accounting > Year-End Closing.

- Select the relevant business year.

- Update the business year details to reflect the new year.

- Check any fixed asset to confirm its display in the new business year.

- Make necessary adjustments and transfers to prepare the fixed asset grid for the new business year.

If you enjoyed reading this blog post, you might be interested in learning more about SAP B1 and how it can benefit your business.

Effective Inventory Planning

A well-executed inventory planning and count is a crucial component of the annual financial closing. Learn how to utilize SAP Business One's inventory management tools to ensure your inventory records are accurate and up-to-date. A well-executed inventory count helps avoid discrepancies, provides insights into your financial position, and lays the foundation for a successful new business year.

- Use SAP Business One's inventory management tools to review your stock levels.

- Conduct a thorough inventory count to reconcile physical inventory with book values.

- Make necessary adjustments to correct any discrepancies.

- Ensure your inventory records are accurate and current.

- At this point, remember to count and verify your fixed assets. You can simplify the inventory count by providing location information in the asset master data.

The year-end closing is a pivotal point in your company's financial development. With SAP Business One, this transition is not only easy but also becomes a competitive advantage through efficient and prompt execution. From creating new accounting periods to managing fixed assets and conducting inventory counts, we've covered the key aspects of this process in detail. If you need further assistance, have questions, or require support in any aspect of your year-end closing, be one solutions is here for you. Our expert team will guide you through the process, provide insights, and ensure a smooth and seamless year-end closing.

Your financial journey is unique, and we are here to ensure its success.

Thank you for reading. Please share it with your colleagues who might be interested in this topic. You can use the buttons below to send it via email or post it on your social media platforms such as Facebook, X (ex-Twitter), or LinkedIn.

You won’t want to miss be one solutions‘ next webinar. Add your email address to be notified :

Please select your language

Welcome on be one solutions‘ websites.

Please select your language.