The Role of SAP Business One for Qualified Invoice System

Blog Summary

- a comprehensive understanding of both local and global perspectives in order to grasp the full scope of implications;

- skillful coordination of all the connected business processes throughout the organization;

- recognition that embracing digitalization and automation is imperative to achieving the aforementioned goals.

While some may perceive this new system as a burden, be one solutions sees it as an opportunity. In fact, we embrace this change as a way to evaluate existing business practices and implement improved, integrated systems. Through our proactive approach, we seek to leverage this transition to drive positive transformation and enhance operational efficiency.

Table of Contents

CloseInvoicing Systems for Global Companies

About SAP Business One

Specifically designed for small and medium-sized businesses, SAP Business One is a compact yet comprehensive ERP solution that excels at providing centralized management for any and all core business operations — the keys to business success. With its robust capabilities in sales, finance, purchasing, inventory control, and overall business management, SAP Business One has been widely adopted by numerous leading companies worldwide. This solution efficiently caters to the needs of businesses operating in multiple languages, dealing with various currencies, and complying with local regulations, making it a trusted choice in the industry.

- Facilitating swift and precise decision-making through data visualization and real-time analytics, thus enabling informed choices;

- Offering scalability at elevated levels, promoting flexibility especially during periods of business expansion;

- Cost-effective implementation costs and swift rollouts;

- Providing a user-friendly experience with powerful functionalities, empowering users to achieve professional performance without requiring specialized IT skills or dedicated system personnel.

Get started with us SAP B1 Partner in Japan

Invoicing Systems and SAP Business One

-

Displaying registration numbers and tax rates: SAP Business One allows the presentation of registration numbers and tax rates on invoices. (Note: the master settings for qualified invoice numbers and layout modifications are supportable even when versions other than Version 10 are used);

-

Flexible tax calculation settings: the system offers a range of settings to handle various tax calculations related to qualified invoices (Note: this functionality is supported in cases where individual invoices do not contain multiple consumption-tax rates even when other versions than Version 10 are used);

-

Handling consumption tax rounding and transfers: SAP Business One facilitates consumption-tax rounding and the transfer of tax differences in closing/consolidated invoices. (Note: To utilize this feature when using closing/consolidated invoices, an upgrade to Version 10 is required).

be one solutions: Your Trusted Global Partner

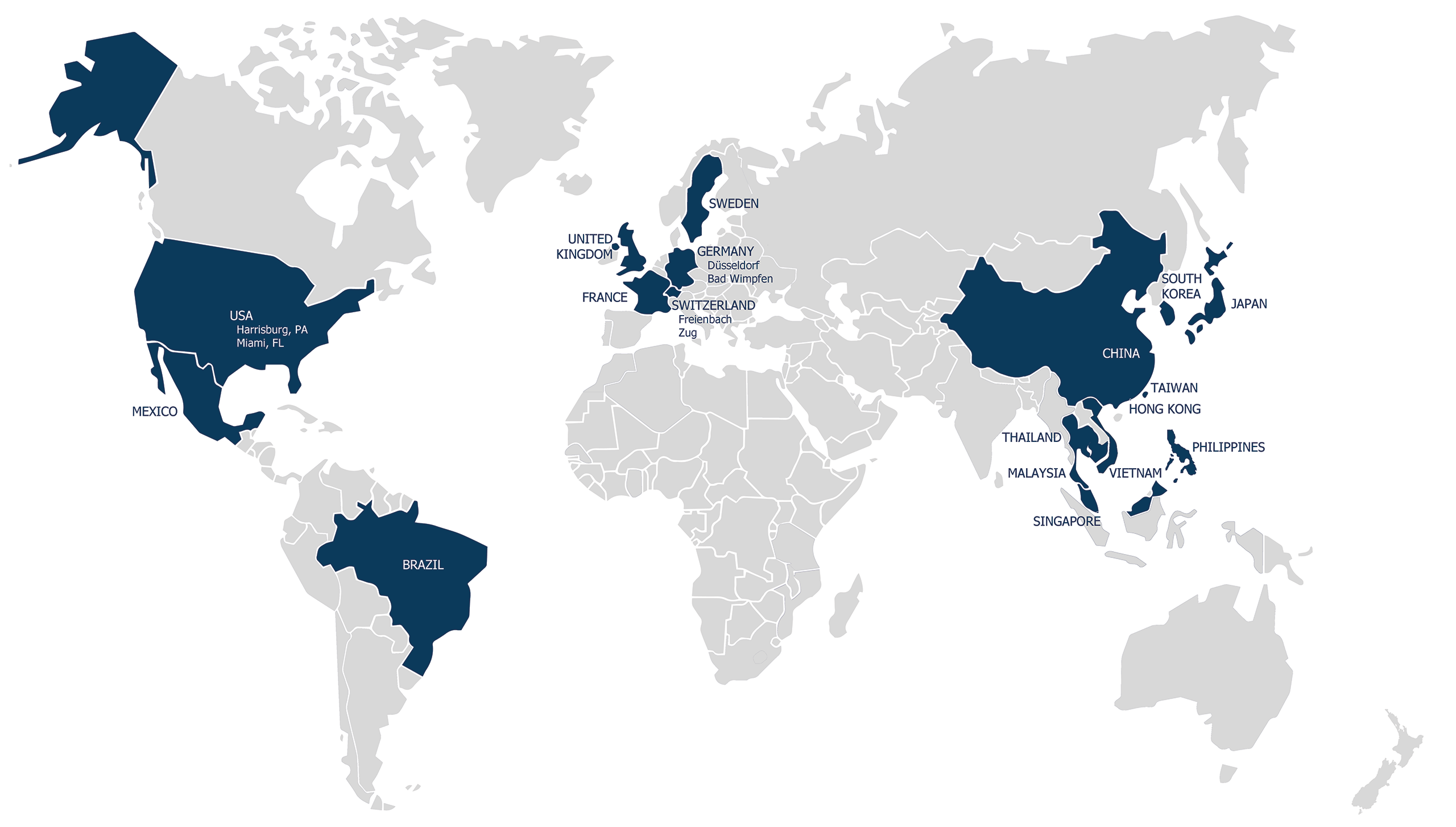

When it comes to implementing ERP systems into businesses with ties to Japan, having a reliable partner capable of providing full support both overseas and in Japan is crucial. As a highly successful global partner of SAP, be one solutions is exactly that. From creating initial blueprints to providing ongoing assistance for global SAP rollouts, we are committed to delivering world-class services. With 18 corporate offices in 27 countries, we have a strong worldwide presence and our team of 150 experts can skillfully maneuver all kinds of business terrains in 18 languages. We are experienced. We are knowledgeable. And we are well trusted by many of the world’s top companies.

References

Japanese Language Overview of Japan’s Invoicing System (Japan National Tax Agency): https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/invoice_about.htm

Other Links

- SAP Business One: https://www.sap.com/products/erp/business-one.html

- English Video Overview of SAP Business One with Japanese Subtitles: https://www.youtube.com/watch?v=7yvNdaiICoI

- Japanese Language PDF Overview of the Qualified Invoice Preservation System (Japan National Tax Agency): https://www.nta.go.jp/taxes/shiraberu/zeimokubetsu/shohi/keigenzeiritsu/pdf/0020006-027.pdf

You won’t want to miss be one solutions‘ next webinar. Add your email address to be notified :

Please select your language

Welcome on be one solutions‘ websites.

Please select your language.